top of page

Private Client

CLIENT BENEFITS

Full-service, personalized planning, and premier portfolio management experience. We optimize and organize everything in your financial life. We then proactively manage all aspects of your wealth strategy from start to finish.

Superior Investment Return Objective

Objective, Fiduciary Advice

No Commission Fee Structure

Institutional, Third-party Custodians

Exclusive, Client-only Digital Tools

Data-driven & Time-tested Strategies

Continuous Rigorous Investment Research

A World-class Investment Team

Private Client Benefits

Click this icon to learn more about each benefit

Your Steps to Build a Life You Love

1

Organize Your

Financial Data

Seamlessly share your essential financial data with our team so we can understand your current situation and build your strategy and action plan to get you to where you want to go.

2

Purposefully write your goals using your custom-built Life Fulfillment Map to clarify what's most important to you and why. Integrate your life and money plans to ensure your money maximizes your fulfillment, not just your net worth. Remember, success without fulfillment is the ultimate failure.

Write Your

Financial Goals

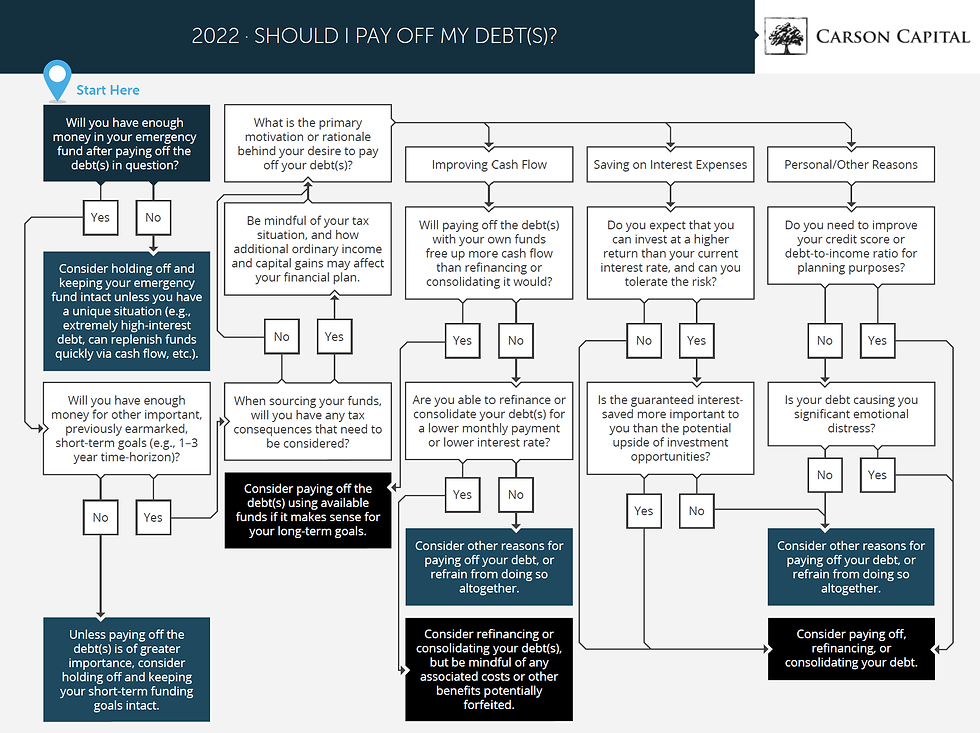

Expert financial decision flowcharts - Carson Capital

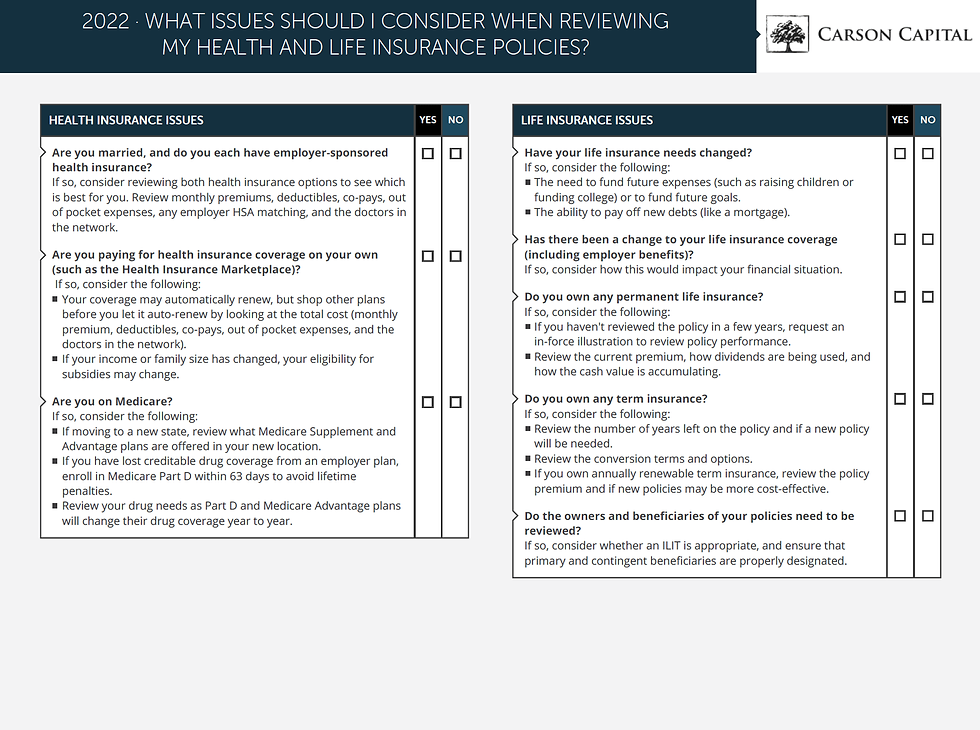

Detailed financial checklists - Carson Capital

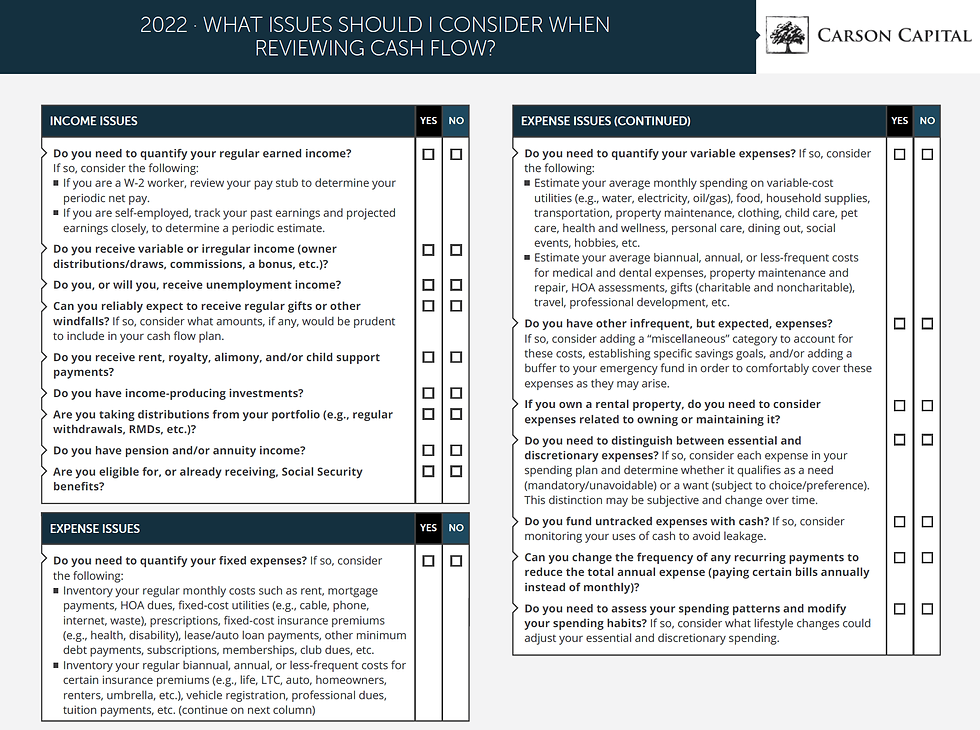

Detailed financial checklists - Carson Capital

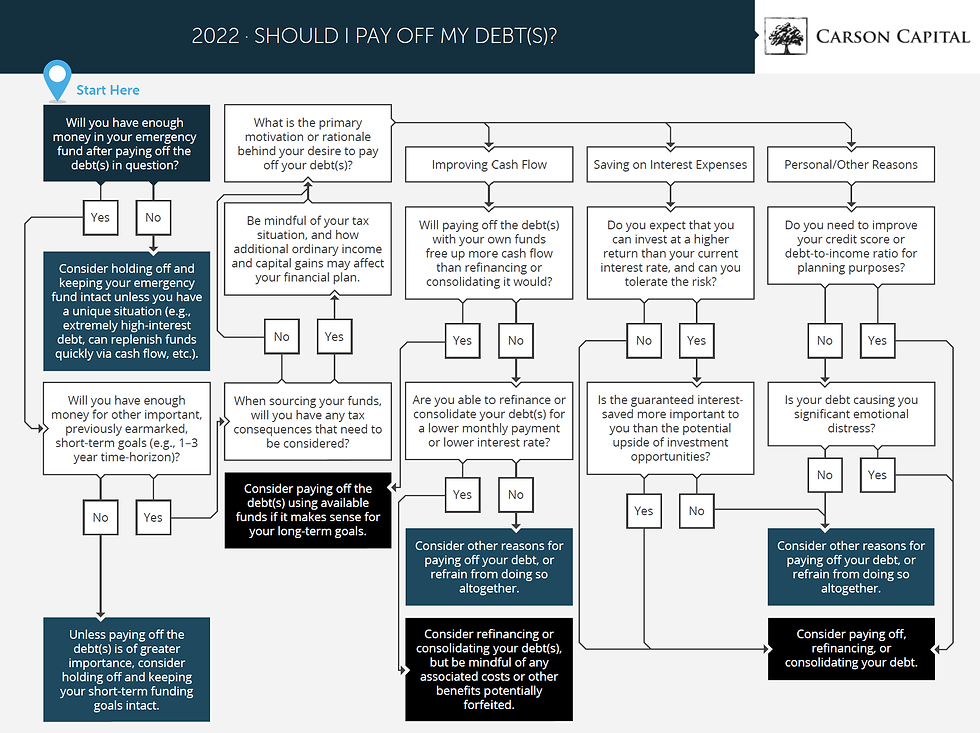

Expert financial decision flowcharts - Carson Capital

1/10

3

Assess Your

Opportunities

We'll distill complex concepts into actionable strategies with our hundreds of flowcharts, checklists & guides built by financial planning experts. We continually create, add, and update our charts to serve our clients best. You'll have access to all of these resources within your member portal, but your dedicated advisor will always be searching to apply this expertise to your specific financial life.

Uncover Potential

Tax Savings

We'll review your tax return thoroughly each year to ensure you are not overpaying the IRS. We'll look for potential mistakes on your return and then make adjustments for the current and future years to minimize your overall tax liability. Like investing, take a long-term view and strategy for the best tax results. As a private client, we're happy to coordinate directly with your other tax and legal professionals.

4

Plan Your

Wealth Strategy

We'll filter all the information and data into one powerful, easy-to-understand document. This document will display big goals, prioritized action items, your financial purpose statement, and vital financial health information. It's magical!

5

6

Automate

to Achieve

Hit your goals and manage your finances in minutes, not hours each month. Our valuable financial systems take significant stress away from remembering to save and invest consistently. Through our automated financial systems, creating your wealth becomes a certainty, not a lottery.

.jpg)

7

Invest with

Conviction

With a deep understanding of your finances, it's time to put our world-class investment team to work for you. We'll use our data-driven and time-tested strategies aiming to manage and grow your wealth strategically. As a Private Client, you'll also have access to top-notch alternative investments.

.png)

Track

Your Progress

"If you can't measure it, you can't manage it." Our industry-leading technology allows you and our team to seamlessly measure your most critical financial indicators to ensure we're on track or to highlight areas of improvement that need our attention.

1/8

Sample Progress Reports

8

Ask

Your Advisor

Every quarter, we'll set aside time for your top questions. This is your chance to get all your questions answered by the Carson Capital team. We invite you to ask us questions specific to your finances, in which case you'll get a private response from us or ask broader questions on anything finance that we can answer for all of our clients. Of course, as our distinguished Private Client you'll have access to your advisor anytime something comes up, not limited to these sessions.

9

Monitor

Proactively

Gain peace of mind knowing a team of experts is monitoring your financial vitals and always looking for ways to improve. We believe our proactivity makes a massive difference in your total financial success because there are generally significant opportunity costs when reacting instead of anticipating and acting in finance.

10

Create Your

Estate Plan

Estate planning is an essential part of completing your financial plan. We've partnered with a five-star national estate planning firm that makes estate planning easy and accessible.

11

12

Master

Financial Topics

Although you'll have full-service financial planning, you'll still get access to all of our expert course videos, webinars, templates, and tools for your top financial needs based on real-life systems used by our high net worth and ultra-high net worth clients.

Strategize Your

Next Move

A greater level of wealth introduces greater complexity. To stay ahead of your financial needs, we proactively work with you to have at least two wealth strategy sessions each year to address your most important financial priorities. Life changes and your plan needs to as well. An initial plan sets you in the right direction, and regular reviews and adjustments keep you going in the right direction to reach your long-term goals.

13

14

Consult

Your Advisor

As a private client, you’ll have priority access to your dedicated advisor whenever you have questions or are facing new financial challenges. We’re here with you every step of the way.

Build a Life You Love

bottom of page